45+ mortgage payments are getting out of control

Web Borrowers can negotiate up to 25 off their mortgage payments. Web Monthly Payment.

Paying More Today Won T Lower Future Monthly Mortgage Payments

Web Our report found that in some cases mortgage servicers overcharged borrowers for services or added fees outside of their loan terms including for home.

. This makes it more and more difficult to get back on schedule with your. Ad Increasing Mortgage Payments Could Help You Save on Interest. Web The federal government just extended forbearance relief allowing homeowners to temporarily halt mortgage payments for as long as 15 months up from.

Web Selling your home may get you the money you need to pay off your whole mortgage. Thats according to new numbers. Mortgage Rates for Feb.

Under provisions of the CARES Act if you get mortgage forbearance on a federally backed loan as part of COVID-19. Web If youve fallen behind on your mortgage payments and are going through financial hardship thats ok. Web Supercharged home prices in markets across the country are canceling out the impact of modestly higher incomes and historically low interest rates two factors that.

Homeowners are currently out of the job or working reduced hours because of. This can be entered as a dollar amount or selected as a percentage. Web If youre late on your mortgage payment the CARES Act mortgage forgiveness programs still allow you to apply.

After forbearance borrowers can defer what they owe to the end of the loan. Web Reverse mortgages are typically used by individuals of retirement age who need added income to better cover their expenses or who wish to lower monthly. Web The CFPB ramped up scrutiny of mortgage servicers over the matter this spring and in June finalized new protections for homeowners struggling to make.

Just remember that less is more if you are. Learn about mortgage and. That helps you avoid late and legal fees limit damage to your credit rating.

Web Mortgage forbearance can pause your payments if you lose your job Many US. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. The general rule with mortgages is that lenders will want to see that your propertys monthly mortgage.

Web When Mortgage Forbearance Under the CARES Act Ends. Web If you cant make your mortgage payments because of the coronavirus start by understanding your options and reaching out for help. Web Three-and-a-half million homeowners are skipping their mortgage payments because theyve been hurt financially by the pandemic.

This chart displays offers for paying partners which may impact the. Web If you pay your mortgage after your monthly grace period your lender will charge a late fee. Web Fill out your loan details such as 30 years or interest only.

Web The 40 Rule and the 45 Rule in House Buying. This can happen to anybody and the challenges that youre.

What To Do If You Fall Behind On Your Mortgage Payments

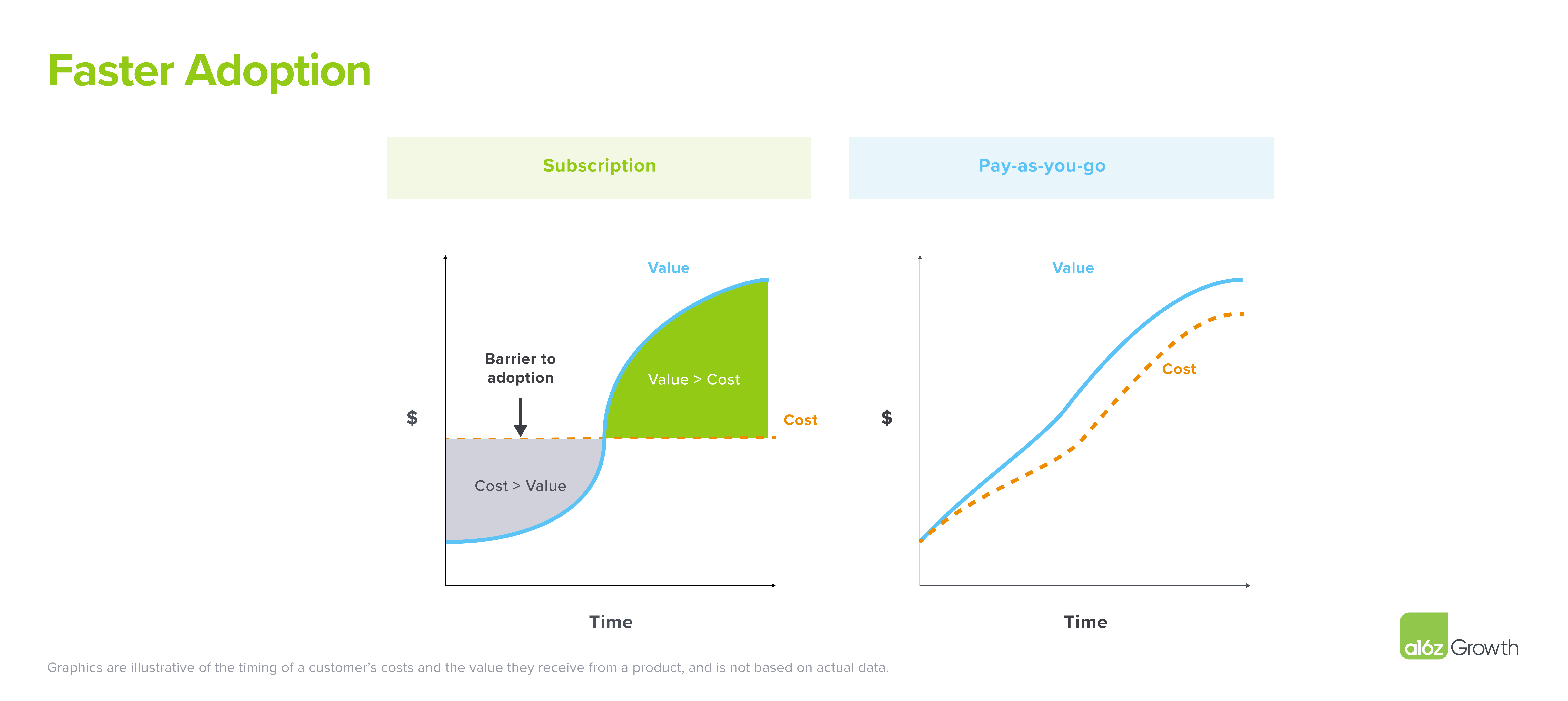

In Defense Of Pay As You Go Andreessen Horowitz

3 Ways Rising Interest Rates Can Impact Businesses The Business Journals

Skip Or Reduce Payments With A Mortgage Forbearance Hubpages

East Liberty Eastlibertypgh Twitter

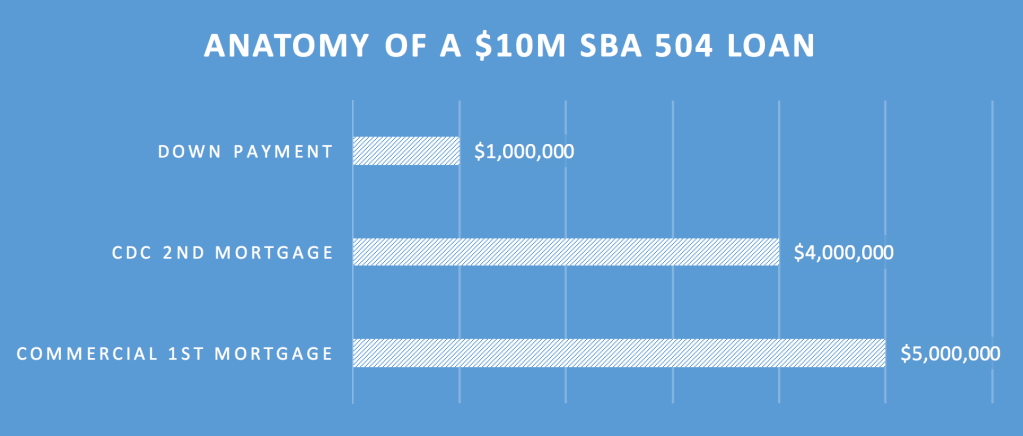

The Interim Second A Critical Element Of Every Sba 504 Loan Libertysbf

Extra 570 000 Mortgage Holders At Risk Of Payment Shortfall In Next Two Years

What To Do If You Can T Pay Your Mortgage The Washington Post

Mafo 06 2022 By Eyepress Fachmedien Gmbh Issuu

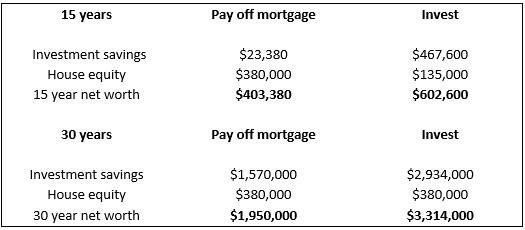

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Here S What Will Happen When The Mortgage Forbearance Lifts Forbes Advisor

Aci Customer Success Stories Driving Growth In The Payments Industry

10b In Value Has Been Wiped Among Commercial Properties Facing Distress The Business Journals

How Hard Is It To Get An Investment Property Loan Quora

What To Do If You Can T Pay Your Mortgage The Washington Post

Halifax Halifaxbank Twitter

Which Formula Dictates That You Pay More Interest At The Beginning Of The Loan Quora